- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Investment Committee Best Practices: Getting Organized

Learn what to include when nonprofit boards create an Investment Committee Charter and Investment Policy Statement.

By John Ferguson, CFA Chief Investment Officer, Foundation & Institutional Advisors

Patrick Nolan, CFA, CMT Senior Portfolio Manager, Foundation & Institutional Advisors

The first step in creating an effective and successful investment committee starts before you select committee members. It starts at the board level with drafting an effective, well-written Investment Committee Charter.

Investment Committee Best Practices: Getting Organized

Whether you are forming a new committee or confirming the focus of your current one, structure and purpose are a good thing to review. The main documents that are involved in this effort are the Investment Committee Charter and the Investment Policy Statement (IPS).

Investment Committee Charter

Many organizations mix a Committee Charter within the Board Policies and the IPS. This approach can be suboptimal with vague committee references, lack of accountability in the board policy and adding complexity to an IPS with no relevance to investments.

Drafted at the board level, the Investment Committee Charter outlines the roles and responsibilities of its members, support staff and, if applicable, external advisors. It should outline the ideal size of the organization’s Investment Committee, which usually stands between five and eight members1.

In our experience, committees under five have a difficult time with achieving quorum and diversity of opinion. Committees over eight have difficulty with decision-making. One struggling committee had 12 members. The committee schedule often had to limit debates to 30 minutes. However, that only left a few minutes for each member to participate. Therefore, debates often went over time, decisions were delayed, more meetings had to be added, and, most importantly, it didn’t allow the committee to address all of the critical items on the agenda.

The Investment Committee Charter should specify the purpose of the assets along with a clear understanding of how to measure success in meeting the organization’s objectives and goals. The Charter should outline what the Investment Committee needs to prepare before, during, and after its meetings, along with the rules for all members while on the Investment Committee. It should outline each member’s commitment to the organization, their fiduciary responsibility, and specify in detail that there should be no conflicts of interest when making decisions.

Finally, the Investment Committee Charter should also outline the term limits and detail the rotation of members on the board and subcommittees. Nonprofits should consider a minimum of five years of service by members and be wary of rotating more than one-third of the committee members in any one term2. One of our clients had a rotation of members every seven years, which caused more than 50% of the board members to roll off at the same time. The training of new members was very disruptive to the board’s mission because the focus had to shift to onboarding rather than on important issues. Additionally, there is a tendency for new members to challenge historical policies. When there is significant turnover in the committee, the details of a decision is occasionally lost. Without a majority of voters available to support these decisions, the committee revisits these policies more frequently than expected. We had a client who finally achieved Qualified Investor status and was eligible for an expanded private investment program. After several quarters of informational meetings, the client decided to move forward with the expanded program. A couple of years later, there was a large rotation of members and the new members did not understand why there was a commitment to an expensive private program with no return while it was still in the J-curve, gaining dramatically after an initial loss. They voted to pause the program while they were educated on the program which took several quarters and negatively impacted their returns.

Investment Policy Statement

Once the committee members are selected, the first priority of any Investment Committee should be to draft an effective Investment Policy Statement (IPS). An IPS is a document that outlines a successful long-term investment process that meets your organization’s unique short- and long-term goals, gives details on how to measure success, and specifies both short- and long-term thresholds on investment decisions that enable the organization to keep human emotions and poor decisions out of the investment process.

The IPS outlines the investment objectives, which will set the guidelines around the critical trade-off between expected reward and risk embedded in the investment process. It will also specify in detail how to assess and judge the investment program’s results. These assessments should be measurable, specified in advance, actionable and attainable, reflective of the investment committee’s risk tolerance, and consistent with the organization’s mission statement and long-term goals3.

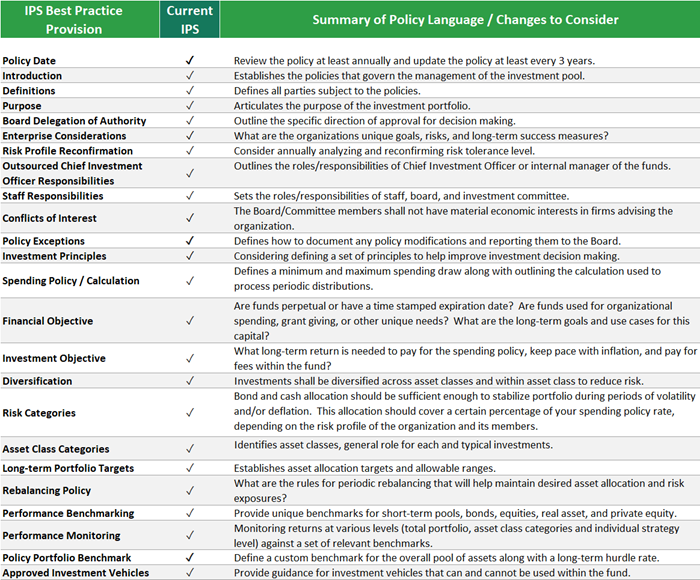

Northern Trust uses a 24 point analysis to outline and draft an effective Investment Policy Statement.

Consideration of these twenty-four points is critical for an organization to provide a structured framework to guide decision-making, ensure alignment with the organization’s unique financial goals, and mitigate both market and behavioral risks associated with investment activities. The policy should clearly set expectations of the committee and its members along with any outside party the committee chooses to engage. One clarity issue we have seen is an IPS that has multiple benchmarks for the portfolio return. The committee may have an overall performance target sometimes stated in the purpose section that is assigned at the board level, for example 60% Global Equity and 40% US Fixed Income. Later in the document, the portfolio target has a more diversified allocation with assigned performance benchmarks. This leads to ambiguity as to which benchmark the Outsourced Chief Investment Officer (OCIO) is expected to beat. In one case, the target ranges did not allow for the OCIO to invest 60% of the portfolio in global equity yet the board expected the OCIO to outperform.

During the Pandemic of 2020, our Advisors were actively engaged with many clients on financial planning and resetting IPS parameters to fit with the dynamic organizational needs. Several of our clients were forced to shut their doors and rely solely on their reserves for expenses. We balanced short-term needs with long-term planning in our firm view that we should overweight risk assets. By documenting these decisions in the policy, the board expectation of performance is corrected by the need to have cash to fund operations while giving credit to Northern Trust’s overweight risk view.

Once finalized and adopted, the Investment Policy Statement becomes a living, breathing document, requiring regular review and updates to reflect changes to your organization’s financial goals and enterprise risk profile.

References:

- Ellis (2010) and Greenwich Roundtable (2014).

- Vanguard, “Fulfilling Your Missions, a Guide to best Practices for Nonprofit Fiduciaries.”

- Bailey, Jeffery V., CFA, and Thomas M. Richards, CFA, “A Primer for Investment Trustees: Understanding Investment Committee Responsibilities,” The CFA Institute Research Foundation, 2017.

LEARN MORE

To help meet your investment and advisory needs, Foundation & Institutional Advisors (FIA) is Northern Trust’s national practice that exclusively serves foundations, endowments and other nonprofit institutional investors as either a dedicated investment advisor or as a fully outsourced chief investment officer. The practice is consultative and advice-driven, providing holistic solutions that combine sophisticated advisory expertise with a spectrum of value-added services.

Meet Your Expert

John Ferguson

CFA, Chief Investment Officer, Foundation & Institutional Advisors

Patrick Nolan

Patrick Nolan

CFA, CMT, Senior Portfolio Manager, Foundation & Institutional Advisors

© 2024 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S.

This document is a general communication being provided for informational and educational purposes only. The opinions and conclusions expressed herein are those of the authors and are not meant to be taken as investment advice or a recommendation for any specific investment product or strategy and does not take your financial situation, investment objective or risk tolerance into consideration. Performance examples are hypothetical and for illustration purposes only and actual results may be lower or higher than a portfolio that may be more or less diversified and/or managed in a different manner. In performing its services, Northern Trust will take into account other relevant facts and circumstances such that positions and transactions for any particular client account may differ with the investments described herein. Northern Trust provides fiduciary and investment management services to various types of accounts, including but not limited to, separately managed accounts, registered and unregistered funds. The investment advice given to one client account may differ from the investment advice given to another client account. Northern Trust and its affiliates may have positions in, and may effect transactions in, the markets, contracts and related investments described herein, which positions and transactions may be in addition to, or different from, those taken in connection with the investments described herein. All information discussed herein is current only as of the date of publication and is subject to change at any time without notice. This material has been obtained from sources believed to be reliable, but its accuracy, completeness and interpretation cannot be guaranteed. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting or tax advice from their own counsel.

All investments involve risk and can lose value. The market value and income from investments may fluctuate in amounts greater than the market. Forecasts may not be realized due to a multitude of factors, including but not limited to, changes in economic conditions, corporate profitability, geopolitical conditions or inflation.

LEGAL, INVESTMENT AND TAX NOTICE. This information is not intended to be and should not be treated as legal, investment, accounting or tax advice.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Periods greater than one year are annualized except where indicated. Returns of the indexes also do not typically reflect the deduction of investment management fees, trading costs or other expenses. It is not possible to invest directly in an index. Indexes are the property of their respective owners, all rights reserved.