STATE RESILIENCY TO MODERATE RECESSION LIKELY STILL HIGH DESPITE SOFTENING REVENUES

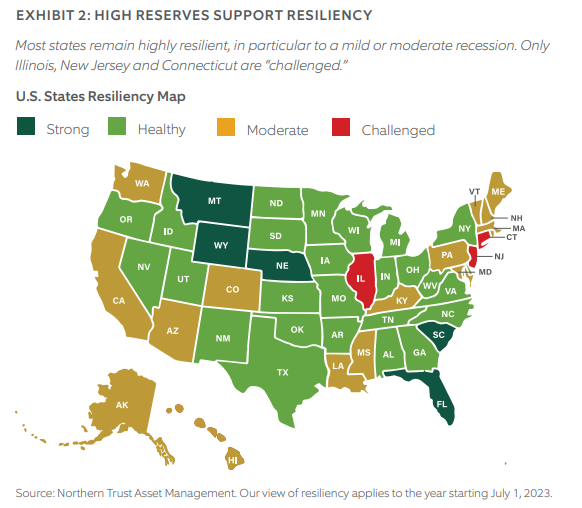

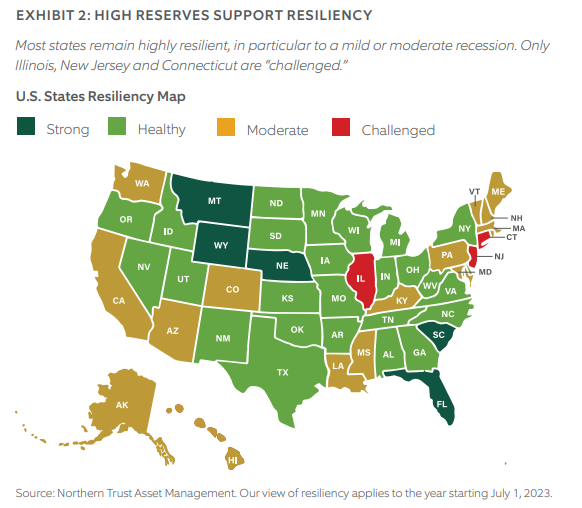

Higher interest rates continue to spur investor worries about recession. Some states have already experienced lower tax revenues than expected in the past few months. In our view, states are generally well prepared for potential economic weakness due to their strong reserves and moderate fixed costs, which we believe will limit credit downgrades and market volatility.

RISING RAINY DAY FUNDS, SLOWING TAX REVENUE

We expect elevated interest rates and reduced bank lending to flatten U.S. economic growth over the next year. Although a recession may not occur in the next year, states are continuing to prepare for one.

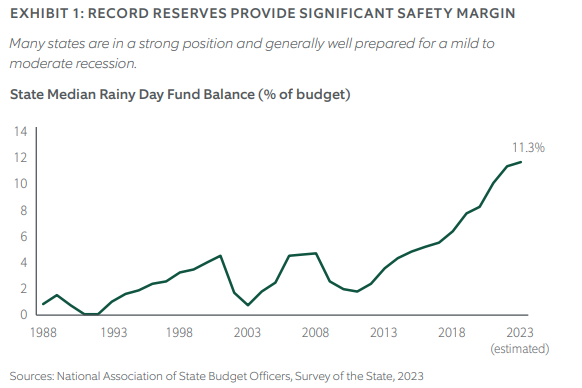

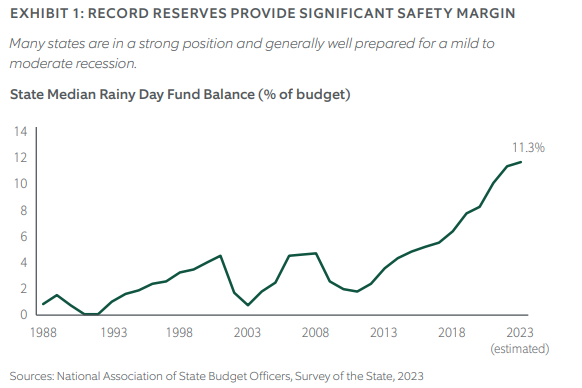

In our view, states are generally well-prepared for a mild to moderate recession. This preparation is largely due to exceptionally strong fiscal 2021 and 2022 revenue growth (most state fiscal years end June 30). State revenues increased by 17% in fiscal 2021 and 15% in fiscal 2022, according to the National Association of State Budget Officers (NASBO). These were the two strongest years of revenue growth since data collection began in 1979, according to NASBO.

States took advantage of the strong revenues by building reserves. Total “Rainy Day Fund” reserve balances grew from $77 billion in fiscal 2020 to $135 billion as fiscal 2022 closed. As a result, the median rainy day balance increased to 12% of state budgets from 8%. These reserves, along with relatively low recent debt issuance and better pension funding, has put many states in a strong position. By comparison, the median state had a rainy day cushion of less than 5% heading into the Great Financial Crisis of 2007-08.

State tax revenue growth has slowed in fiscal 2023. According to the Urban Institute, for the nine months through March, total state revenues decreased by 2% compared to the prior year. This decline, if it holds throughout the entire fiscal year, would mark a sizable shift from the surge in the previous two years, but would still be well above pre- pandemic levels.

Income tax and sales tax are the two main sources of tax income for states. Sales tax growth has remained stable (helped by inflation), but income tax growth has softened notably, particularly in states more reliant on capital gains. Poor investment returns in calendar 2022 notably impacted tax returns filed in April 2023.

In recent months, several states that report revenues monthly have begun to show weakness:

- Massachusetts: Through May, the state collected 5% less tax revenues compared to the same 11 months in fiscal 2022. Much of the decline came from April income tax payments. However, May revenues rebounded to increase by nearly 10% over last year. Tax revenues for the year are 3% below the state’s budget.

- North Carolina: Through May, tax revenues fell 1% versus the same 11-month period in fiscal 2022. April revenues alone were down by 14%. Tax revenues for the year are less than 1% below the budget.

- Ohio: For the first 11-months of Ohio’s fiscal year 2023, tax revenues increased by 3% over fiscal 2022. April revenues however were 17% below April 2022. Tax receipts for the year are still more than 3% over the budget.

These softening revenues have tempered states’ budget plans for fiscal 2024, which are still being finalized in many states. In California, the governor’s revised budget proposal called for $224 billion of spending in fiscal 2024, down from $236 billion in fiscal 2023.

STATE RESILIENCY

Even the best managed states experience financial volatility. Recessions can hit state budgets from both sides. Historically, tax revenues have declined during recessions at the same time as the need rises to spend on social safety-net programs. Unexpected events such as natural disasters, terrorist attacks, civil unrest or pandemics can also radically change state budget forecasts. States have fiscal tools to manage these events, including raising new revenues, reducing or delaying spending, refinancing debt, borrowing or using reserves. These sovereign powers are a key part of why we favor state bonds.

Key factors in evaluating state resiliency include:

- Reserves: Reserves increase a government’s fiscal safety margin. Reserve accumulation is particularly important for states with volatile revenue structures. California for example, depends heavily on capital gains and Alaska depends on oil revenues.

- Fixed Costs: Legacy costs, such as pensions, retiree health and debt service, reduce budgeting flexibility. Illinois, for example, expects to spend $10 billion for pensions and $2 billion for debt service in fiscal 2024 — a large share of its anticipated $46 billion of tax revenues.

- Management: We favor states that can quickly change revenue forecasts, when conditions warrant, and to quickly adjust spending accordingly. In Ohio, if the governor believes that tax receipts will fall below expected spending, he or she is required to order state agencies to reduce spending. Well-managed states also have improved resiliency to disasters and other event risks. California, for example, has added spending in recent years to manage state forests to reduce wildfire risk.

FEDERAL SPENDING STEADY

The federal largess of the COVID-19 pandemic has largely ended, but federal spending for key programs appears unchanged as a result of the debt ceiling deal. The deal eliminated a key uncertainty for now. The law that suspended the debt ceiling until 2024 contains no changes to programs such as Medicaid, a major shared state-federal

responsibility. Federal capital aid from the Bipartisan Infrastructure and Jobs Act of 2021 is also unchanged. Some states still have stimulus funds available, which must be spent by 2026.

FINANCIALLY WEAK STATES SHOW SOME STRENGTH BUT REMAIN VULNERABLE

Illinois (4th largest bond issuer), New Jersey (7th) and Connecticut (19th) are among the major municipal bond-issuing states. These state general obligation credits have improved recently, but all three, notably Illinois, remain weak compared to other states. The improvements are largely due to a buildup in reserves, restrained debt issuance and better pension funding. All three have recently used surpluses to make additional deposits to their pension funds.

The impact of these achievements is tempered, however, as all three remain weak compared to peers. Reserves are lower, pension liabilities are higher, and key revenue drivers — economic and population growth — are slower than the state median.

Historically, these states have exhibited a proclivity to prioritize short-term budgets over long-term sustainability, meriting close monitoring in case of recession. A reversion to these habits could cause volatility in each state’s bonds.

EYE ON CALIFORNIA

California issuers make up over 16% of the municipal market — by far the most of any state. The state’s tax revenues are volatile, due to a heavy dependence on a highly progressive income tax and its large tech industry. Its credit rating has improved markedly since 2010, rising to the AA category from the BBB category as a result of better management and strong economic growth. The state has over $37 billion of reserves (about 17% of annual spending), preparing it well for any downdraft in tax revenues.

In fiscal 2023, revenues have swung sharply negative, largely as a result of a decline in capital gains tax revenues. Through May, tax revenues are down by 29%, compared to fiscal 2022, and are well below budgeted levels. The steepness of this decline is due in part to the Internal Revenue Service’s decision (and the state’s subsequent conformity) to delay tax filing deadlines to October from April because of a federal disaster declaration in February due to severe weather and landslides.

We remain constructive on California’s credit due to strong reserves and liquidity, reduced debt levels and effective management. The state is currently debating its fiscal 2024 budget, and the governor has proposed resolving the budget shortfall through a mix of budget cuts and delayed spending, while retaining reserves.

WHAT THIS MEANS FOR MUNICIPAL BOND INVESTORS

We believe states are entering fiscal 2024 in a strong position due to sizable reserves, but there are signs that the strong revenue growth of recent years is ebbing. Federal pandemic aid has ended, raising the stakes for state fiscal management should the nation fall into recession. Our expectation is that in a moderate recession scenario, state resiliency should remain strong, limiting credit downgrades and market volatility. We continue to consider state bonds to be a key part of core municipal portfolios.

IMPORTANT INFORMATION. For Asia-Pacific markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. Information is subject to change based on market or other conditions.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Past performance is no guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by Northern Trust. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. Investment management/advisory fees are described in Northern Trust Investments, Inc. Form ADV Part 2A.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

© 2023 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.